October 2023 marks the third year of my budgeting journey. Before October 2020, I never took budgeting seriously. Though I always wanted to track my spending, but found it too complex. I had several credit cards, which I heavily used for expenses. Sometimes payments also happened on cash basis. Initially, I used an expense-tracking app to track cash flow. The app was used to read SMS and automatically categorize expenses. Most of the time, the app wrongly categorized expenses. Also, the app could not differentiate between cash and credit card spend.

My idea for cash flow management was that credit card spending is cash flow for the next month (when we pay credit card bills- how wrong I was?). After trying for a few months, I stopped tracking cash flow. It was too tedious and complex.

Then something happened in October 2020, which pushed me to keep control over my expenses. I had taken a home loan. Usually, a home loan is the biggest loan, one takes in life. Now, I needed to keep tight control over my spending because besides paying home loan repayment, I needed to save towards investments.

This time, I used an old method of expense tracking, i.e. tracking expenses in a diary. Over time, I refined and improved the process. Now, it has been three years or 36 months of continuous tracking. It has now been ingrained in my behavior. On the last day of every month, I feel the anxiety of knowing my financial position.

First few steps are always hard. In this post, I will elaborate on the budgeting process in simple steps. While making a monthly budget, I decided to streamline my credit card spending. Here is how you can approach the same.

Budgeting Step-1: Managing Multiple Credit Cards

If you use multiple credit cards, you would have found it difficult to keep a tab on tracking your spending. Also, sometimes it becomes tedious to remember different payment dates. A missing payment date means a big penalty. I decided to simplify this. Firstly, I reduced the number of credit cards from 7 to 4. It is a one-time 10 mins investment to get a card cancelled. The customer care guy will entice you with offers to keep the card alive. But you do not deviate from this punchline “ I want to close this card”.

If you can live with one credit card only, even better. Then, decide to use only one credit card for all kinds of transactions. Change the billing cycle, so that bill payment date occurs on the 5th of every month for all credit cards. But, you need not wait till the 5th for payment of bills. On the first weekend, after you get your salary, pay all your credit card bills. By this, you save precious money on unnecessary credit card penalties. You also keep your mind free from worries by paying all bills before time. Needless to say, this will lead to a big thumbs up to your credit score.

Budgeting Step-2: Buy a diary

You have to keep this process sacrosanct. This diary will only be used for writing your budget, nothing else. This diary must have at least 50-60 pages so that the same diary can be used for years. Please do not use digital diaries (word doc, notepad, etc.) for this process. We shall use a paper diary and write on it with a pen. Please note that Budgeting is a behavioral finance exercise. Writing has a more profound impact on your brain than typing.

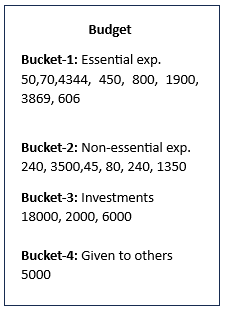

Budgeting Step-3: Categorize Expenses into Four Buckets

Let’s divide all your expenses into four buckets. Managing four categories is easy. Our whole objective is to cut the clutter and keep this process simple enough.

Bucket-1: Essential expenses

Bucket-2: Non-essential expenses

Bucket-3: Investments

Bucket-4: Given to others

Bucket-1:

This bucket is for essential expenses only. Essential expenses are such expenses that are required to live your life with dignity. Grocery, utility bills, rent, school fees, kid’s education-related expenses, traveling cost to office/ school, etc. come under this category. To decide, if some expense is essential or not, ask yourself this question. “If you lose your job, will you still spend money on this?” If the answer to the question is yes, then it is an essential expense, otherwise not.

Bucket-2:

This bucket is for non-essential expenses only. Any non-essential expense will come under this bucket. Eating out, party expenses, buying non-essential gadgets, unnecessary OTT or gym subscriptions, etc. come under non-essential expenses. You can ask yourself the same question, as in Bucket-1 to decide about non-essential expenses.

Bucket-3

This is your most important bucket, called the investment bucket. You should strive to invest/ save at least 20% of your take-home income. If you are using mutual funds, set up SIP for automatic deduction from your bank account. If you can save more than 30% of your take-home salary, you are on a fast tack to financial freedom.

Before making an investment for growth, you need investment for safety. You need to create an Emergency Fund to provide a safety cushion to your investment and save you from sudden financial impacts. You can learn more about the Emergency Fund here.

Bucket-4

Expenses, which are not covered above will be listed here. For example, money lent to someone, payment to charity etc will come here.

Budgeting Step-4: Start Tracking/ Recording Your Expenses in Notes App

You must already have a “Notes” app in your smartphone. You can also use Google Keep, ColorNote, Notepad, OneNote, etc. apps. Open a new page in this app and name the page as budget.

Use your Notes app on your mobile to note down expenses on a real-time basis. That means, immediately recording the expense in a proper bucket. Do not wait till the evening. You just need to record the amount. That’s it. A typical Note on your smartphone looks like this.

Every Sunday, you have to note down all expenses from the app to your diary. Again, sit on the last date of the month to add all numbers in a particular bucket and we have monthly expense data with us. As there are 4 weeks in a month, you need to record expenses 4 times monthly.

Repeat this process for 2-3 months. You will have a ballpark estimate of your essential expenses and non-essential expenses. Remember: You don’t need to be accurate. Ballpark estimates keep this process easy and keep your life simple.

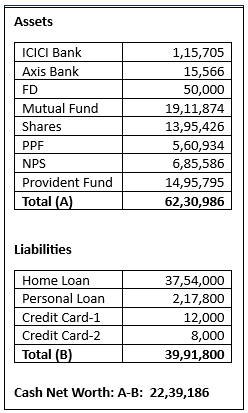

Budgeting Step-5: Making Your Personal Balance Sheet

After recording expenses in your diary, on the last day of the month, you need to draw your balance sheet. This balance sheet will give you a clear picture of your financial standing. It is a simple process, just follow the below steps.

We first note down the list of Assets, then Liabilities, and then calculate Net Worth (by subtracting Liabilities from Assets)

Assets include cash in the bank, the value of the investment in mutual fund accounts, stocks, FDs, and Retirement funds such as the Public Provident Fund (PPF), National Pension Scheme (NPS), Contributary Provident Fund, etc. I have not added real estate, because we are trying to ascertain cash net worth. These assets can be termed as cash assets.

Liabilities include any debt that you have taken such as home loan, personal loan, credit card debt etc.

Asset minus Liabilities will give you cash net worth. Please have a look at the below picture for more clarity.

This Cash Net Worth will be a good indicator of your financial position as of that date. If you have to retire tomorrow, this cash is available to you immediately.

Budgeting Step-6: Review of Expenses

On the first day of the month or the last date of the previous month, you need to review expenses done in the previous month. Usually, you will find most of the expenses in buckets 1, 2, and 3 only. It is recommended to keep sum of essential and non-essential expenses less than 80% of your take-home pay. The investment bucket must be at least 20% of your take-home pay. If you are below 20%, make all efforts, including reducing non-essential expenses to reach at least 20% investment target. If you can increase bucket 3 to 30% or 40% or 50%, you will reach the financial independence stage very soon.

On the very same day, you also review your personal balance sheet. If you are in a negative Net Worth stage, make serious efforts to increase your assets, while reducing your liabilities. To increase assets, you need to increase funds towards investments. To decrease liabilities, reduce non-essential expenses. Reduce/ avoid debt. Also, avoid taking on more debt. Get rid of high-cost debt (debt at high rate of interest) first. Once you reach at a positive Net Worth category, keep on increasing this number.

Repeat Every Month

You need to repeat this exercise every month. The initial few months would be tougher, but ultimately tracking budget and balance sheet would become your second nature by fourth or fifth month.

Conclusion

What gets measured, gets improved. Budgeting of your finances is the first step of your financial journey. Consistent efforts will definitely keep you in that path. I am sure, you will improvise the above methodology to suit your style. Do you have any comments, please let me know.

[…] Track Your Expenses […]

[url=http://fjksldhyaodh.com/]Fiobabafa[/url] Iwouzu svy.zdgn.npsmoney.com.hzu.sl http://fjksldhyaodh.com/

Excellent write-up

Wow, incredible blog format! How long have you been running a blog for?

you make blogging look easy. The entire look of your site is fantastic, as well as the content

material! You can see similar: sklep internetowy and here sklep online

Insightful piece

Hey there, I appreciate you posting great content covering that topic with full attention to details and providing updated data. I believe it is my turn to give back, check out my website https://tuk.ru/bitrix/redirect.php?event1=&event2=&event3=&goto=http://webemail24.com/increase-your-online-income-through-email-marketing for additional resources about Website Design.

wargaqq

Fantastic goods from you, man. I’ve understand

your stuff prior to and you’re just extremely great.

I actually like what you’ve bought right here, certainly

like what you’re stating and the best way by

which you are saying it. You are making it enjoyable and you still

care for to keep it smart. I cant wait to learn far more

from you. This is really a tremendous website.

erek erek 57

I think this is among the most important information for me.

And i’m glad reading your article. But should remark on few

general things, The website style is perfect, the articles is really nice : D.

Good job, cheers

Hi i am kavin, its my first occasion to commenting anywhere, when i read

this post i thought i could also make comment due to this good paragraph.

Hi there! Do you use Twitter? I’d like to follow you if that would be ok.

I’m undoubtedly enjoying your blog and look forward to new

posts.

Hi, just wanted to tell you, I liked this post.

It was inspiring. Keep on posting!

Very nice post. I just stumbled upon your blog and wished to say that I have really enjoyed

browsing your blog posts. In any case I’ll be subscribing for your feed

and I am hoping you write once more soon!

Having read this I thought it was rather informative.

I appreciate you finding the time and energy to put this content together.

I once again find myself personally spending a significant amount of time both reading and commenting.

But so what, it was still worth it!

Thank you for the auspicious writeup. It in fact was

a amusement account it. Look advanced to far added agreeable from you!

However, how could we communicate?

Why users still make use of to read news papers when in this technological

world everything is presented on net?

Great info. Lucky me I ran across your website by accident (stumbleupon).

I’ve bookmarked it for later!

Awesome! Its genuinely remarkable article, I have got much clear idea

about from this paragraph.

Can you tell us more about this? I’d care to find out more details.

# Harvard University: A Legacy of Excellence and

Innovation

## A Brief History of Harvard University

Founded in 1636, **Harvard University** is the oldest and one of the most prestigious higher

education institutions in the United States. Located in Cambridge, Massachusetts, Harvard has built a global reputation for academic excellence, groundbreaking research, and influential alumni.

From its humble beginnings as a small college established to educate clergy, it has evolved into a world-leading university

that shapes the future across various disciplines.

## Harvard’s Impact on Education and Research

Harvard is synonymous with **innovation and

intellectual leadership**. The university boasts:

– **12 degree-granting schools**, including the renowned **Harvard Business School**,

**Harvard Law School**, and **Harvard Medical School**.

– **A faculty of world-class scholars**, many of

whom are Nobel laureates, Pulitzer Prize winners, and pioneers in their fields.

– **Cutting-edge research**, with Harvard leading initiatives in artificial intelligence,

public health, climate change, and more.

Harvard’s contribution to research is immense, with billions

of dollars allocated to scientific discoveries and technological advancements each year.

## Notable Alumni: The Leaders of Today and Tomorrow

Harvard has produced some of the **most influential figures** in history, spanning politics, business,

entertainment, and science. Among them are:

– **Barack Obama & John F. Kennedy** – Former U.S.

Presidents

– **Mark Zuckerberg & Bill Gates** – Tech visionaries (though Gates did not graduate)

– **Natalie Portman & Matt Damon** – Hollywood icons

– **Malala Yousafzai** – Nobel Prize-winning activist

The university continues to cultivate future leaders who shape industries and drive global

progress.

## Harvard’s Stunning Campus and Iconic Library

Harvard’s campus is a blend of **historical charm and modern innovation**.

With over **200 buildings**, it features:

– The **Harvard Yard**, home to the iconic **John Harvard

Statue** (and the famous “three lies” legend).

– The **Widener Library**, one of the largest university

libraries in the world, housing **over 20 million volumes**.

– State-of-the-art research centers, museums, and performing arts venues.

## Harvard Traditions and Student Life

Harvard offers a **rich student experience**, blending academics with vibrant traditions,

including:

– **Housing system:** Students live in one of 12 residential houses,

fostering a strong sense of community.

– **Annual Primal Scream:** A unique tradition where students

de-stress by running through Harvard Yard before finals!

– **The Harvard-Yale Game:** A historic football

rivalry that unites alumni and students.

With over **450 student organizations**, Harvard students engage in a diverse range of extracurricular activities, from entrepreneurship to performing arts.

## Harvard’s Global Influence

Beyond academics, Harvard drives change in **global policy, economics, and technology**.

The university’s research impacts healthcare, sustainability, and artificial intelligence, with partnerships across industries worldwide.

**Harvard’s endowment**, the largest of any university, allows it

to fund scholarships, research, and public initiatives, ensuring a legacy of impact for

generations.

## Conclusion

Harvard University is more than just a school—it’s a **symbol of excellence, innovation, and leadership**.

Its **centuries-old traditions, groundbreaking discoveries, and transformative education** make it one of the most

influential institutions in the world. Whether through its

distinguished alumni, pioneering research, or vibrant

student life, Harvard continues to shape the

future in profound ways.

Would you like to join the ranks of Harvard’s legendary scholars?

The journey starts with a dream—and an application!

https://www.harvard.edu/

Hey very nice blog!

Yes! Finally something about 1.

Hey There. I found your weblog the use of msn. This is a very neatly written article.

I’ll be sure to bookmark it and return to learn more of your helpful info.

Thanks for the post. I’ll definitely return.

It’s going to be finish of mine day, except before finish I am reading this enormous paragraph to increase my know-how.

Hey there! I could have sworn I’ve been to this blog before but after checking through some of the post I

realized it’s new to me. Anyways, I’m definitely happy I found it and

I’ll be book-marking and checking back frequently!

Hi, everything is going sound here and ofcourse every one is

sharing information, that’s in fact fine, keep up writing.

Thank you for the good writeup. It in fact was a amusement

account it. Look advanced to far added agreeable from you!

By the way, how can we communicate?